Run a smarter fleet with Verilocation

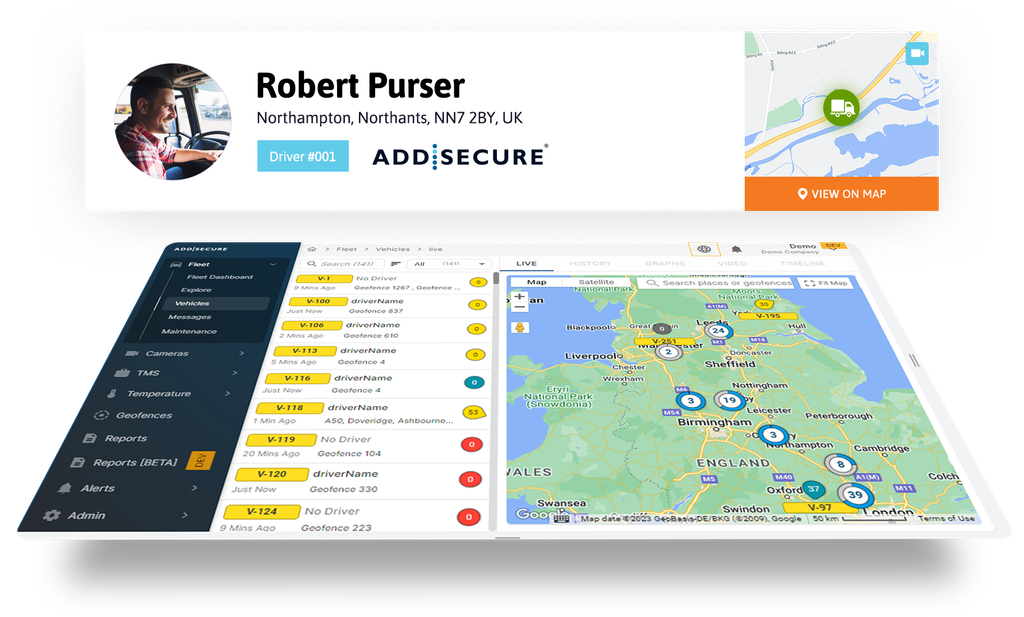

Verilocation, AddSecure's fully customisable web-based telematics platform provides full fleet visibility 24/7, allowing you to monitor, manage and optimise your fleet operations on every level.

Reduce costs and improve safety

From vehicle tracking and integrated cameras through to our comprehensive Transport Management interface, the Verilocation platform encompasses a wide range of solutions aimed at reducing operating costs, improving fleet safety and taking customer service to the next level.

Verilocation Platform features

Vehicle tracking

Effectively control and manage your fleet operations with real-time GPS vehicle tracking and driver performance analysis through Verilocation’s custom built web-based telematics platform.

Driver Performance

Improve your fleet’s bottom line and maximise your return on investment with Verilocation’s market leading driver performance and behaviour monitoring solution.

Tachograph Data

Verilocations integrated Remote Tachograph Download solution ensures your fleet remains both compliant and fully optimised at all times.

Temperature Monitoring

With real-time temperature updates and threshold alerting, you can ensure your temperature-sensitive goods are maintained and delivered within the correct conditions, giving you and your customers complete peace of mind.

Vehicle Camera Systems

With the Verilocation platform working in conjunction with our range of industry leading camera systems you can protect your fleet and improve safety

Request a demo

Request a demo of the industries leading fleet management platform and make your fleet safer and smarter.

“Since installing the multi-camera and driver performance solution, we have seen a 30% reduction in incident rates which has led to a saving of over £50,000 on our fleet insurance.”

Steve Bremner, Head Of Transport Services, LLYNCH